Originally posted on this blog on March 8, 2022:

Little Rock, Arkansas voters rejected a sales tax increse in 2021.

From the Arkansas NPR affiliate:

Little Rock Voters Reject Proposed Sales Tax Increase

Little Rock voters rejected Mayor Frank Scott Jr.’s proposed one-cent sales tax increase by a nearly two-to-one margin yesterday.

Unofficial vote totals show just over 13,000 votes were cast against the tax increase. Just under 8,000 people voted in favor of it. Of the over 120,000 registered voters in the city, only around 21,000 ballots were cast in the election.

“While this election did not turn out as we’d hoped,” Scott said in a statement, “I’m grateful for the members of the City Board who placed this proposal before the voters and the people of Little Rock who campaigned with me for a stronger, more vibrant city.”

The tax proposal, branded by Scott as “Rebuild the Rock,” was intended to use revenue for the tax to improve recreation areas around the city, improve early childhood education, and other quality-of-life improvements.

Scott said “We always knew this would be a difficult journey—the pandemic has caused a great deal of uncertainty.”

In a statement, members of the Vote No Sales Tax September 14 ballot committee say they are “elated” to see the tax did not pass.

“This was a bad plan and the people could see it, it’s as simple as that,” said committee co-chair Greg Moore. “Even though it had many high-profile supporters and sold itself as if it would help low-income families.”

“Many families in Little Rock are hurting from this pandemic,” added committee co-chair Valencia White, “They did not need the cost of their groceries increased.”

Both committee co-chairs are members of Arkansas Community Organizations, a group that enables working and low-income families to fight for social and economic justice. Members have pointed out that there are things within the city’s power now to improve citizens’ lives.

Moore said “They should work hard to reach out to communities in order to find out what people really need and bring people into their future plans.” He also said that the city should work on getting everyone vaccinated and using the federal pandemic funds to rebuild the community.

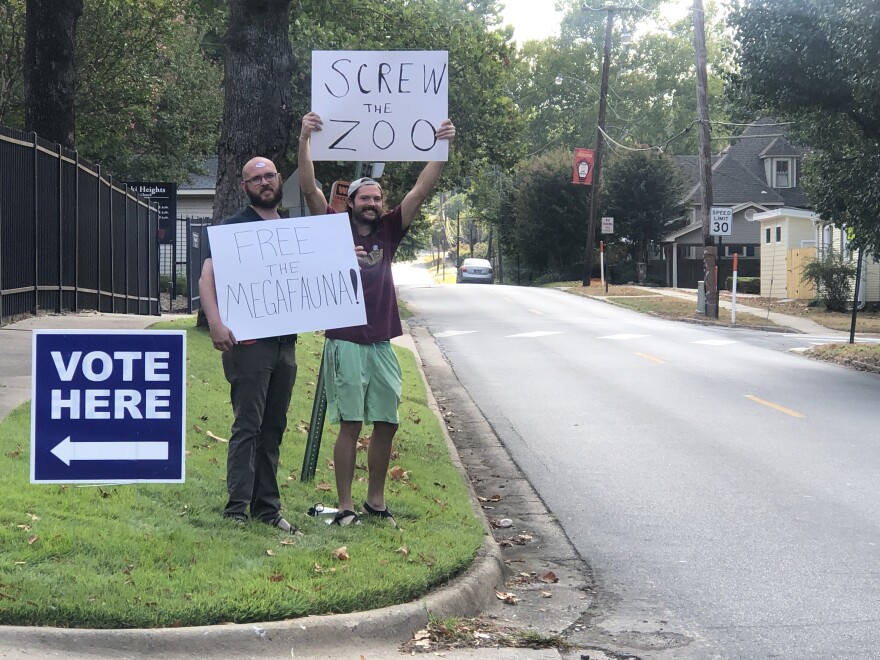

While the mayor urged residents to approve the tax increase, voters on Election Day criticized particular aspects of the proposal. Nick D’Auteuil held a sign in front of a polling place at Pulaski Heights United Methodist Church on Tuesday urging passersby to vote against it.

He said he doesn’t see the benefit of new taxes funding improvements to the Little Rock Zoo.

“I just think zoos are kind of archaic, they’re outdated. We know that animals live longer lives in the wild,” D’Auteuil said. “I don’t think that a $22 million giraffe exhibit is going to do very much for the city.”

A common criticism of the tax proposal highlighted the fact that Little Rock would have had an overall sales tax rate of 9.625% by next year. But voter Marilyn Micheletti said the higher cost to taxpayers would have been worth it to help fund improvements to the city’s parks and recreation.

“It’s not that much. If you go to Maumelle, it’s already 9.5%. It’s not that different from other cities… and we use all of these facilities, we go there, why not contribute to them?”

Little Rock’s overall sales tax is set to drop to 8.625% next year as a three-eights percent sales tax originally approved in 2011 is set to expire.

Scott said he would work with the city Board of Directors “to make the necessary adjustments” for the expiring tax and that he would “keep fighting to Rebuild the Rock.”

No comments:

Post a Comment