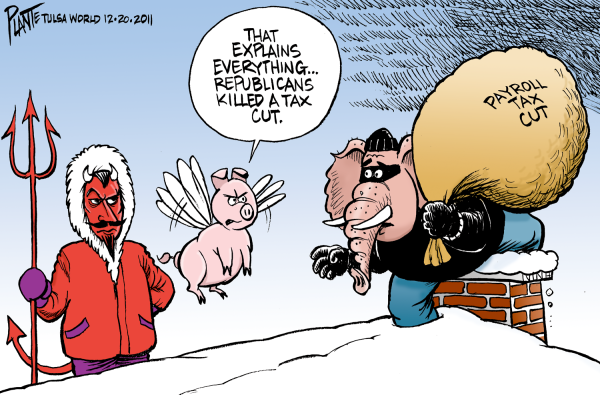

Republicans were once a party of fiscal conservatism. Now, four of the five Republicans on St. Johns County Commission want you to approve a 15%+ sales tax increase. Republicans are all about reducing taxes for billionaires and Benedict Arnold corporations.

But the people of St. Johns County are intelligent and skeptical.

And a survey of recent news articles shows that American voters are revolting -- very often voting against tax increases and wasteful spending. Read more:

- On March 8, 2022, Camden County, Georgia voters rejected Spaceport Camden, an environmentally dangerous boondoggle that threatened our Cumberland Island National Seashore.

- Volusia County, Florida voters rejected a sales tax increase in 2019.

- Osceola County, Florida voters rejected a sales tax increase by a 2-to-1 margin in 2019

- Ashhtabula County, Ohio voters rejected a sales tax increase in 2021.

- Little Rock, Arkansas voters rejected a sales tax increase in 2021.

- Hannibal, Missouri voters rejected a sales tax increase in 2021.

- Bryan County, Oklahoma voters rejected a sales tax increase in 2021.

Our Florida Supreme Court and the Arizona Supreme Court were not shy about striking down unconstitutional sales taxes in 2021 and 2022, respectively

- On March 8, 2022, the Arizona Supreme Court struck down a Pinal County (Phoenix) sales tax ordinance that illegally exempted sales of $10,000 or more. Plaintiffs were represented by the Goldwater Institute. https://arizonadailyindependent.com/2022/03/08/arizona-supreme-court-rules-pinal-county-tax-illegal/

- Last year, our Florida Supreme Court struck down a Hillsborough County (Tampa) sales tax referendum whose text promised specific projects, finding it violated our Florida Constitution. https://www.wtsp.com/article/news/local/hillsboroughcounty/hillsborough-county-transportation-tax-ruled-unconstitutional/67-e9af8de4-cbc8-4d91-8ae2-5c3ef684a662

Unlike the Republicans of 50 years ago, our current Commissioners don't appear to be fiscal conservatives. They refuse to scrutinize the Sheriff's budget, despite a massive embezzlement scheme over five years.

Funded by secretive developers, these Commissioners lack thoroughness. They have no staff.

The sapless "legislative branch" in St. Johns County sit like satraps, surrounded by Executive Branch employees who spoon-feed them their information.

Do St. Johns County Commissioners mostly act like developer puppets?

You tell me.

Look around you at the deforestation, flooding, clearcutting, burning of trees, killing of wildlife, filling of wetlands, destruction of our history and nature.

Compliant Commissioners won't trouble landraping scalawag developers and internalize the external costs of "development."

They won't tighten their belts.

They won't learn from their mistakes.

They don't perform meaningful oversight,

They have no committee system.

They disdain public comment.

They won't attack waste, fraud, abuse, misfeasance, malfeasance and nonfeasance, political patronage, embezzlement, self-dealing.

No.

Are our five Republican St. Johns County Commissioners guilty of"willful blindness?"

St. Johns County Commissioners want you to vote to raise sales taxes.

Only Commissioner Paul Waldron has the common sense to say no to this Dull Republican scheme, which would relieve developers of hundreds of millions of dollars in property taxes, impact fees and concurrency.

No Commissioners have moved on government reforms, like lobbyist registration, an ombudsman and a County Charter that would provide for limited government, protect human rights, and establish badly needed checks and balances.

We don't even have lobbying registration, thanks to massive resistance by lobbyists and their louche lapdogs.

If the sales tax is not linked to government reform, I will vote against it.

A 2015 half penny sales tax referendum "for schools" was really for developers, relieving them of some $150 million to $200 million in property taxes and impact fees over ten years.

The campaign for the half penny sales tax cost some $187,000 -- the Return on Investment (ROI) was at least 33,200%. Know of any legal business with an ROI like that?

Enough flummery, dupery and nincompoopery.

No comments:

Post a Comment