Occupying an entire Sea Grove office building in St. Augustine Beach, Lydia Cladek defrauded investors as she employed 100 employees, while stealing $100 million.

St. Johns County has harbored several fraudulent schemes, all empowered by the desuetude of State's Attorney RALPH JOSEPH LARIZZA and Sheriff DAVID BERNARD SHOAR, who legally changed his name from "HOAR" in 1994.

At age 93, eighteen (18) years from now, on September 21, 2037, convicted fraudfeasor LYDIA I. CLADEK will be released from federal prison after serving her federal prison sentence of 30 years and four (4) months for running a $100 million fraud, euchring investors with a get-rich-quick scheme involving 29% interest rate used automobile loans, which bankrupted dozens, including local residents, while ripping off low-income purchasers with low credit scores.

CLADEK was a generous contributor to local churches and nonprofits, albeit with stolen money.

CLADEK was a pillar of St. Augustine Beach, where her LYDIA CLADEK, INC. corporate HQ occupied two floors of an office building at Sea Grove (the former beautiful location of Cooksey's Campground).

LYDIA I. CLADEK is know known as Federal Bureau of Prisons (BOP) inmate no. 53820-018, serving her sentence at the Coleman Florida Federal Correctional Institution.

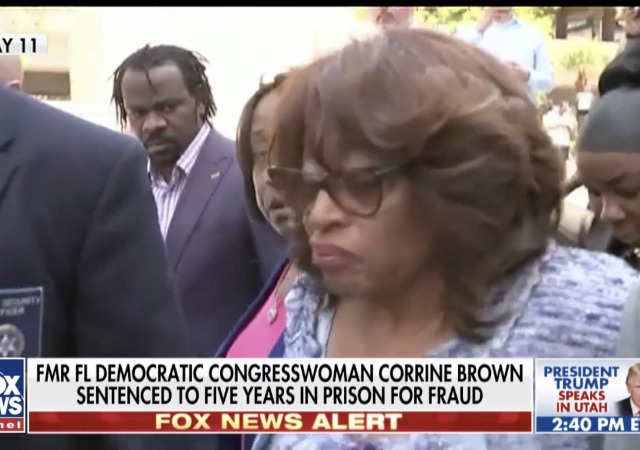

Among other inmates at Coleman FCI with LYDIA CLADEK disgraced former Jacksonville Democratic Congresswoman CORINNE BROWN, BOP inmate no. 67315-018, who will be released on June 6, 2022, at age 75, after serving five years in federal prison. BROWN was found guilty of defrauding contributors to a phony nonprofit scholarship charity, using the funds as her own personal piggy bank.

,

To corrupt Florida fraudfeasors: it can happen to you.

The FBI, SEC, FDLE and OFR are watching.

So are we.

As Jimmy Carter said, "I see no reason why bigshot crooks should go free, and the poor ones go to jail."

And as the late Memphis law professor W.H. "Toby" Sides put it, "The pigs get fat but the hogs get slaughtered."

The Court of Appeals affirmed Cladek's 365 month prison sentence:

IN THE UNITED STATES COURT OF APPEALS

FOR THE ELEVENTH CIRCUIT ________________________

No. 13-10024 ________________________

D.C. Docket No. 3:10-cr-00277-TJC-TEM-1 UNITED STATES OF AMERICA,

No. 13-10024 ________________________

D.C. Docket No. 3:10-cr-00277-TJC-TEM-1 UNITED STATES OF AMERICA,

Appeal from the United States District Court for the Middle District of Florida ________________________

(September 22, 2014) Before HULL, MARCUS, and BLACK, Circuit Judges.

PER CURIAM:

After a jury trial, defendant-appellant Lydia Cladek was convicted of one

count of conspiracy to commit wire fraud and mail fraud, 18 U.S.C. §§ 1341, 1343,

PER CURIAM:

After a jury trial, defendant-appellant Lydia Cladek was convicted of one

count of conspiracy to commit wire fraud and mail fraud, 18 U.S.C. §§ 1341, 1343,

Case: 13-10024 Date Filed: 09/22/2014 Page: 2 of 26

1349, four substantive counts of wire fraud, id. § 1343, and nine substantive counts of mail fraud, id. § 1341. The district court imposed a total sentence of 365 months’ imprisonment. On appeal, Cladek challenges only her conviction of the conspiracy offense and her 365-month sentence. After careful review of the record and the briefs, and with the benefit of oral argument, we affirm.

I. CLADEK’S FRAUD SCHEME

Cladek challenges the sufficiency of the evidence as to her conspiracy conviction. Cladek argues there was insufficient evidence that she formed an agreement with another person to accomplish an unlawful object. Therefore, we describe the trial evidence of Cladek’s fraud and of unindicted co-conspirator Ivette Reyes’s knowing participation in that scheme.A. The Formation of Cladek’s Company, LCI

Around 1998, defendant Cladek formed a business in St. Augustine, Florida—Lydia Cladek, Inc. (“LCI”). LCI’s original business model was to:

(1) receive money from investors in exchange for LCI’s executing one- or two- year fixed interest promissory notes payable to the investors; (2) use investor money to purchase subprime auto loan notes at discounts; (3) pledge auto loan notes as security for the investors’ notes; (4) service the auto loan notes and thus collect the high interest payments attached to them; and (5) pass a percentage of

I. CLADEK’S FRAUD SCHEME

Cladek challenges the sufficiency of the evidence as to her conspiracy conviction. Cladek argues there was insufficient evidence that she formed an agreement with another person to accomplish an unlawful object. Therefore, we describe the trial evidence of Cladek’s fraud and of unindicted co-conspirator Ivette Reyes’s knowing participation in that scheme.A. The Formation of Cladek’s Company, LCI

Around 1998, defendant Cladek formed a business in St. Augustine, Florida—Lydia Cladek, Inc. (“LCI”). LCI’s original business model was to:

(1) receive money from investors in exchange for LCI’s executing one- or two- year fixed interest promissory notes payable to the investors; (2) use investor money to purchase subprime auto loan notes at discounts; (3) pledge auto loan notes as security for the investors’ notes; (4) service the auto loan notes and thus collect the high interest payments attached to them; and (5) pass a percentage of

2

Case: 13-10024 Date Filed: 09/22/2014 Page: 3 of 26

the money earned from the auto loan notes back to investors and keep the rest as profit.

Cladek promised investors interest payments of between fifteen and eighteen percent. Cladek also represented that the promissory notes LCI executed would be fully collateralized by the auto loans, and that, if an auto loan defaulted, was paid off, or became unsecured (because a car was wrecked or stolen), LCI would use reserve funds to purchase a replacement auto loan note.

Specifically, the promissory notes LCI executed stated: “[LCI] hereby pledges and assigns to [the investor] all of its interests in the automobile retail installment sales contracts listed on attached Addendum[.]” The notes warranted: (1) “[t]he contracts hereby assigned as collateral are genuine and valid”; (2) “[t]he contract[s] hereby assigned are free and clear of all liens and encumbrances”;

(3) “[LCI] shall not, until such time as all of the terms of the promissory notes are met, subject the contracts to any other liens or encumbrances”; and (4) “[LCI] agrees to maintain a principal balance of collateral equal to or in excess of payee’s loan.”B. Ivette Reyes’s Role at LCI

At trial, one of the government’s key witnesses was Ivette Reyes. In 2001, Reyes started working for LCI, when LCI employed only five or six people. Reyes continued working there until February 2010. Reyes started working at LCI after

Cladek promised investors interest payments of between fifteen and eighteen percent. Cladek also represented that the promissory notes LCI executed would be fully collateralized by the auto loans, and that, if an auto loan defaulted, was paid off, or became unsecured (because a car was wrecked or stolen), LCI would use reserve funds to purchase a replacement auto loan note.

Specifically, the promissory notes LCI executed stated: “[LCI] hereby pledges and assigns to [the investor] all of its interests in the automobile retail installment sales contracts listed on attached Addendum[.]” The notes warranted: (1) “[t]he contracts hereby assigned as collateral are genuine and valid”; (2) “[t]he contract[s] hereby assigned are free and clear of all liens and encumbrances”;

(3) “[LCI] shall not, until such time as all of the terms of the promissory notes are met, subject the contracts to any other liens or encumbrances”; and (4) “[LCI] agrees to maintain a principal balance of collateral equal to or in excess of payee’s loan.”B. Ivette Reyes’s Role at LCI

At trial, one of the government’s key witnesses was Ivette Reyes. In 2001, Reyes started working for LCI, when LCI employed only five or six people. Reyes continued working there until February 2010. Reyes started working at LCI after

3

Case: 13-10024 Date Filed: 09/22/2014 Page: 4 of 26

her mother, Ruth Reyes, had first worked for Cladek. Initially, Reyes was a secretary. In April 2001, Reyes began doing accounting work and later became the head of LCI’s accounting department.

One of Reyes’s accounting duties was overseeing LCI’s general operating account. Reyes prepared checks from that account for Cladek to sign. These checks were for interest payments to investors and for purchasing subprime auto loan notes from car dealers. Reyes also deposited investors’ checks into that account.

Additionally, Reyes prepared promissory notes, from LCI to be issued to investors, for Cladek to sign. Upon receiving an investor’s check, Reyes entered information about the investor and the investment into a standard form and then sent Cladek a draft promissory note. Cladek signed all of the promissory notes Reyes prepared.

Reyes’s third main duty was attaching collateral to the promissory notes. To do this, Reyes accessed a database containing information about all of the auto loan notes LCI owned. Reyes selected a set of auto loan notes having a total value of usually about ten to twenty percent more than the amount of the promissory note. The attachment of collateral occurred only after Cladek signed a promissory note. Reyes had discretion to determine which auto loan notes to attach to which promissory notes.

One of Reyes’s accounting duties was overseeing LCI’s general operating account. Reyes prepared checks from that account for Cladek to sign. These checks were for interest payments to investors and for purchasing subprime auto loan notes from car dealers. Reyes also deposited investors’ checks into that account.

Additionally, Reyes prepared promissory notes, from LCI to be issued to investors, for Cladek to sign. Upon receiving an investor’s check, Reyes entered information about the investor and the investment into a standard form and then sent Cladek a draft promissory note. Cladek signed all of the promissory notes Reyes prepared.

Reyes’s third main duty was attaching collateral to the promissory notes. To do this, Reyes accessed a database containing information about all of the auto loan notes LCI owned. Reyes selected a set of auto loan notes having a total value of usually about ten to twenty percent more than the amount of the promissory note. The attachment of collateral occurred only after Cladek signed a promissory note. Reyes had discretion to determine which auto loan notes to attach to which promissory notes.

4

Case: 13-10024 Date Filed: 09/22/2014 Page: 5 of 26

C. LCI’s Success

At first, LCI was very successful. Growing from a five-person operation in 2001, LCI soon employed close to 100 people in three separate departments— collections, purchasing, and accounting.

LCI’s business was so prosperous that it outgrew the small, converted house it used as office space. Around 2006, LCI moved into an office building large enough to house each of LCI’s departments.D. Misuse of Investor Funds

Although LCI was successful, it did not adhere to its original business model. Instead of using investor funds to purchase new auto loan notes (and then extracting profits from interest payments on the auto loan notes), Cladek funneled LCI investor funds to her own personal account.

Reyes, who oversaw LCI’s general operating account, testified that LCI used its single operating account to: (1) hold investor money; (2) pay interest to investors; and (3) hold money collected on auto loan notes LCI owned. Reyes cut checks from these commingled funds payable directly to Cladek. Usually, these checks were for approximately $8,950. Occasionally, in a single day, Reyes would draft as many as seven $8,950 checks payable to Cladek.

Reyes testified that she also cut checks from LCI’s operating account payable to an individual named Roby Roberts, even though she did not know who

At first, LCI was very successful. Growing from a five-person operation in 2001, LCI soon employed close to 100 people in three separate departments— collections, purchasing, and accounting.

LCI’s business was so prosperous that it outgrew the small, converted house it used as office space. Around 2006, LCI moved into an office building large enough to house each of LCI’s departments.D. Misuse of Investor Funds

Although LCI was successful, it did not adhere to its original business model. Instead of using investor funds to purchase new auto loan notes (and then extracting profits from interest payments on the auto loan notes), Cladek funneled LCI investor funds to her own personal account.

Reyes, who oversaw LCI’s general operating account, testified that LCI used its single operating account to: (1) hold investor money; (2) pay interest to investors; and (3) hold money collected on auto loan notes LCI owned. Reyes cut checks from these commingled funds payable directly to Cladek. Usually, these checks were for approximately $8,950. Occasionally, in a single day, Reyes would draft as many as seven $8,950 checks payable to Cladek.

Reyes testified that she also cut checks from LCI’s operating account payable to an individual named Roby Roberts, even though she did not know who

5

Case: 13-10024 Date Filed: 09/22/2014 Page: 6 of 26

Roberts was. In fact, in January 2005, Roberts agreed to sell Cladek a bayfront residential property located in Captiva, Florida for a total price of $2.74 million. Cladek owed Roberts monthly payments of $12,057.29. Cladek held this property as a personal real estate investment. Thus, Cladek used LCI investors’ funds to pay for her own investments. By cutting checks to unknown individuals who were unaffiliated with LCI, Reyes helped Cladek divert LCI funds to benefit Cladek personally.

Not only did Cladek use investor funds for personal investments, she also used them to buy her own personal residence. In 2004, Cladek moved into a new home in a gated, beachfront community. One former LCI investor described the residence as a “[g]orgeous[,] . . . million-dollar house” that featured a “[b]eautiful kitchen,” a swimming pool, and a guest house. Another former investor recalled a “beautiful, expensive home.” Among the home’s flourishes were: (1) a dining room table and chair set that was custom made and cost approximately $25,000; (2) a piano costing approximately $17,000; and (3) over 40 pieces of furniture for the pool area, including teak outdoor chairs each costing more than $600.

As more and more LCI money went to Cladek’s personal expenses and investments, less and less went to LCI’s auto loan buying business. In 2008, LCI, at Cladek’s direction, reduced its auto loan note buying to an almost nonexistent level. One former employee testified that LCI went from buying “50 or 60 loans a

Not only did Cladek use investor funds for personal investments, she also used them to buy her own personal residence. In 2004, Cladek moved into a new home in a gated, beachfront community. One former LCI investor described the residence as a “[g]orgeous[,] . . . million-dollar house” that featured a “[b]eautiful kitchen,” a swimming pool, and a guest house. Another former investor recalled a “beautiful, expensive home.” Among the home’s flourishes were: (1) a dining room table and chair set that was custom made and cost approximately $25,000; (2) a piano costing approximately $17,000; and (3) over 40 pieces of furniture for the pool area, including teak outdoor chairs each costing more than $600.

As more and more LCI money went to Cladek’s personal expenses and investments, less and less went to LCI’s auto loan buying business. In 2008, LCI, at Cladek’s direction, reduced its auto loan note buying to an almost nonexistent level. One former employee testified that LCI went from buying “50 or 60 loans a

6

Case: 13-10024 Date Filed: 09/22/2014 Page: 7 of 26

day down to just maybe one or two loans a day.” Accounting head Reyes testified that she was aware of the dwindling number of auto loan notes that LCI purchased because she “cut the checks for the purchasing department.”E. Attempts to Conceal LCI’s Fraud

Not surprisingly, LCI’s misuse of investor funds created a shortage of auto loan notes to serve as collateral for the promissory notes it issued to investors.

Reyes testified that, from April 2001 (when she started doing accounting work) until sometime in 2003, she had no difficulty attaching auto loan notes as collateral for LCI’s promissory notes. In 2003, Reyes was preparing investors’ quarterly reports when she ran out of collateral. Reyes told Cladek, who told her not to worry about it and said, “We’ll take care of it.”

Cladek did not, however, take care of the problem. Reyes, therefore, did not send quarterly reports to those investors for whose notes LCI did not have enough collateral. The next quarter, Reyes sent statements to only those investors who had not received a statement previously. Eventually, at Cladek’s direction, Reyes adopted a standard practice of issuing semiannual, instead of quarterly, reports.

At some point, to remedy the collateral shortage, Cladek instructed Reyes to pull collateral from the promissory notes of Cladek’s family members and friends. Reyes did so. Cladek also instructed Reyes to take collateral from existing promissory notes and assign it to new notes as new investment funds came in.

Not surprisingly, LCI’s misuse of investor funds created a shortage of auto loan notes to serve as collateral for the promissory notes it issued to investors.

Reyes testified that, from April 2001 (when she started doing accounting work) until sometime in 2003, she had no difficulty attaching auto loan notes as collateral for LCI’s promissory notes. In 2003, Reyes was preparing investors’ quarterly reports when she ran out of collateral. Reyes told Cladek, who told her not to worry about it and said, “We’ll take care of it.”

Cladek did not, however, take care of the problem. Reyes, therefore, did not send quarterly reports to those investors for whose notes LCI did not have enough collateral. The next quarter, Reyes sent statements to only those investors who had not received a statement previously. Eventually, at Cladek’s direction, Reyes adopted a standard practice of issuing semiannual, instead of quarterly, reports.

At some point, to remedy the collateral shortage, Cladek instructed Reyes to pull collateral from the promissory notes of Cladek’s family members and friends. Reyes did so. Cladek also instructed Reyes to take collateral from existing promissory notes and assign it to new notes as new investment funds came in.

7

Case: 13-10024 Date Filed: 09/22/2014 Page: 8 of 26

Reyes testified that, when a new promissory note came in, “I would

take . . . someone that had a collateral sheet, I would look at their notes, see how much they had. And I would kind of make note of where I was putting it to, and kind of keep track for myself where I was putting it, and assign it to that other person.”

Although Reyes knew that the promissory notes “had to have buyable collateral attached to them,” she created more than one promissory note having the same collateral attached to it as attached to another note. Reyes also testified that no investor ever gave her permission to pull the collateral from his or her note and apply it to someone else’s note. But Reyes did so anyway, and, at trial, she identified collateral sheets reflecting auto loan notes that she personally assigned to multiple investors.

Doubly assigning the same collateral (instead of buying more auto loan notes to serve as collateral) did not fix the collateral shortage. Reyes testified that she was aware of the problem every day she came to work between 2003 and 2010, and that she knew it was getting worse through the years.F. LCI’s Demise

In the summer of 2008, LCI began receiving calls from investors concerned about their investments. The calls became more frequent throughout the remainder

take . . . someone that had a collateral sheet, I would look at their notes, see how much they had. And I would kind of make note of where I was putting it to, and kind of keep track for myself where I was putting it, and assign it to that other person.”

Although Reyes knew that the promissory notes “had to have buyable collateral attached to them,” she created more than one promissory note having the same collateral attached to it as attached to another note. Reyes also testified that no investor ever gave her permission to pull the collateral from his or her note and apply it to someone else’s note. But Reyes did so anyway, and, at trial, she identified collateral sheets reflecting auto loan notes that she personally assigned to multiple investors.

Doubly assigning the same collateral (instead of buying more auto loan notes to serve as collateral) did not fix the collateral shortage. Reyes testified that she was aware of the problem every day she came to work between 2003 and 2010, and that she knew it was getting worse through the years.F. LCI’s Demise

In the summer of 2008, LCI began receiving calls from investors concerned about their investments. The calls became more frequent throughout the remainder

8

Case: 13-10024 Date Filed: 09/22/2014 Page: 9 of 26

of 2008. Reyes fielded these calls. She told Cladek about them, but, as Reyes testified, she and Cladek “never really thought of a solution for it.”

The situation deteriorated as investors began attempting to withdraw their money. Reyes testified that, sometime after the 2008 financial crisis began, investors were asking for approximately $100,000 per day. That number then started to rise. The calls from angry investors became so disruptive that Reyes and the other accounting personnel were unable to get their work done. They asked Cladek to route the calls to someone else and Cladek agreed to do so.

In late 2009, Cladek convened a meeting attended by Reyes and other LCI employees. At the meeting, Cladek dictated a script for employees to use when dealing with angry investors. When an investor called attempting to withdraw his or her money, the LCI employee was to inform the investor that the auto loan notes were performing as expected and that LCI would soon be buying more subprime auto loan notes. Cladek told the employees, including Reyes, to tell customers that she had “been proven to have unprecedented success” and that “plans [were] in place.”

Meanwhile, in 2008, the U.S. Securities and Exchange Commission (“SEC”) received an anonymous complaint about LCI alleging that Cladek was operating a Ponzi scheme. The SEC passed the complaint along to Florida’s Office of Financial Regulation (“OFR”). In December 2008 and January 2009, the OFR

The situation deteriorated as investors began attempting to withdraw their money. Reyes testified that, sometime after the 2008 financial crisis began, investors were asking for approximately $100,000 per day. That number then started to rise. The calls from angry investors became so disruptive that Reyes and the other accounting personnel were unable to get their work done. They asked Cladek to route the calls to someone else and Cladek agreed to do so.

In late 2009, Cladek convened a meeting attended by Reyes and other LCI employees. At the meeting, Cladek dictated a script for employees to use when dealing with angry investors. When an investor called attempting to withdraw his or her money, the LCI employee was to inform the investor that the auto loan notes were performing as expected and that LCI would soon be buying more subprime auto loan notes. Cladek told the employees, including Reyes, to tell customers that she had “been proven to have unprecedented success” and that “plans [were] in place.”

Meanwhile, in 2008, the U.S. Securities and Exchange Commission (“SEC”) received an anonymous complaint about LCI alleging that Cladek was operating a Ponzi scheme. The SEC passed the complaint along to Florida’s Office of Financial Regulation (“OFR”). In December 2008 and January 2009, the OFR

9

Case: 13-10024 Date Filed: 09/22/2014 Page: 10 of 26

contacted several of LCI’s investors and heard their concerns. Later in 2009, the OFR requested and received from LCI all promissory notes and accompanying documents LCI issued between 2004 and 2008.

Reyes was aware of the OFR’s investigation and helped Cladek compile documents to send to the investigators. Further, Reyes testified that she was aware of the subject of the investigation, stating “Lydia informed us what it was for and what she wanted to accomplish. And we just did whatever she told us.” Not surprisingly, Reyes did not include copies of the ledgers showing doubly assigned collateral in the documents she turned over.

The OFR turned the results of its investigation over to the FBI. LCI ceased its operations in May 2010 after the FBI executed a search warrant and LCI’s creditors forced the company into involuntary bankruptcy proceedings.G. Indictment, Arrest, and Trial

On November 19, 2010, a federal grand jury indicted Cladek, charging her with the conspiracy, mail fraud, and wire fraud offenses stated above. Cladek pled not guilty and went to trial. At the conclusion of the government’s case, Cladek moved for judgment of acquittal as to all counts.

As for the conspiracy count, Cladek argued that there was insufficient evidence that she formed an agreement with any other person to accomplish an unlawful objective. Cladek’s attorney noted that the government’s theory was that

Reyes was aware of the OFR’s investigation and helped Cladek compile documents to send to the investigators. Further, Reyes testified that she was aware of the subject of the investigation, stating “Lydia informed us what it was for and what she wanted to accomplish. And we just did whatever she told us.” Not surprisingly, Reyes did not include copies of the ledgers showing doubly assigned collateral in the documents she turned over.

The OFR turned the results of its investigation over to the FBI. LCI ceased its operations in May 2010 after the FBI executed a search warrant and LCI’s creditors forced the company into involuntary bankruptcy proceedings.G. Indictment, Arrest, and Trial

On November 19, 2010, a federal grand jury indicted Cladek, charging her with the conspiracy, mail fraud, and wire fraud offenses stated above. Cladek pled not guilty and went to trial. At the conclusion of the government’s case, Cladek moved for judgment of acquittal as to all counts.

As for the conspiracy count, Cladek argued that there was insufficient evidence that she formed an agreement with any other person to accomplish an unlawful objective. Cladek’s attorney noted that the government’s theory was that

10

Case: 13-10024 Date Filed: 09/22/2014 Page: 11 of 26

Reyes was Cladek’s co-conspirator, but that “[t]here was not any testimony that demonstrated that Ms. Reyes knew any unlawfulness having to do with any of [her] acts.” The district court denied the motion.

Thereafter, the jury found Cladek guilty on all counts. Afterwards, Cladek renewed her motion for judgment of acquittal, again arguing that Reyes “never acknowledged knowing that her action[s] were unlawful or criminal in nature.” The district court denied the post-trial motion too.

II. SUFFICIENCY OF THE EVIDENCE ISSUE

With this factual background, we turn to Cladek’s first issue on appeal— whether there was sufficient evidence to support her conspiracy conviction.A. Standard of Review

We review de novo whether there was sufficient evidence to support a conviction, viewing the evidence and drawing all inferences in favor of the verdict. United States v. Isaacson, 752 F.3d 1291, 1303 (11th Cir. 2014). We will not overturn a jury’s verdict if “any reasonable construction of the evidence would have allowed the jury to find the defendant guilty beyond a reasonable doubt.” United States v. Grzybowicz, 747 F.3d 1296, 1304 (11th Cir. 2014) (quotations omitted). “It is not necessary for the government’s evidence to be inconsistent with every reasonable hypothesis except that of guilt in order to be sufficient.” United States v. Silvestri, 409 F.3d 1311, 1328 (11th Cir. 2005).

Thereafter, the jury found Cladek guilty on all counts. Afterwards, Cladek renewed her motion for judgment of acquittal, again arguing that Reyes “never acknowledged knowing that her action[s] were unlawful or criminal in nature.” The district court denied the post-trial motion too.

II. SUFFICIENCY OF THE EVIDENCE ISSUE

With this factual background, we turn to Cladek’s first issue on appeal— whether there was sufficient evidence to support her conspiracy conviction.A. Standard of Review

We review de novo whether there was sufficient evidence to support a conviction, viewing the evidence and drawing all inferences in favor of the verdict. United States v. Isaacson, 752 F.3d 1291, 1303 (11th Cir. 2014). We will not overturn a jury’s verdict if “any reasonable construction of the evidence would have allowed the jury to find the defendant guilty beyond a reasonable doubt.” United States v. Grzybowicz, 747 F.3d 1296, 1304 (11th Cir. 2014) (quotations omitted). “It is not necessary for the government’s evidence to be inconsistent with every reasonable hypothesis except that of guilt in order to be sufficient.” United States v. Silvestri, 409 F.3d 1311, 1328 (11th Cir. 2005).

11

Case: 13-10024 Date Filed: 09/22/2014 Page: 12 of 26

B. Elements of the Conspiracy Offense

The jury convicted Cladek of conspiracy to commit mail and wire fraud. Thus, the jury found that the government proved the following elements beyond a reasonable doubt: (1) “an agreement between two or more persons”; (2) “to execute a scheme to defraud”; and (3) “the use of either the mails or wire service in furtherance of the scheme.” United States v. Ross, 131 F.3d 970, 981 (11th Cir. 1997).

Because conspiracy is “predominantly mental in composition,” there need not be “a formal agreement” between co-conspirators as long as there is “a meeting of the minds to commit an unlawful act.” United States v. Toler, 144 F.3d 1423, 1426 (11th Cir. 1998) (quotations omitted). To that end, a jury may use circumstantial evidence to infer the existence of an agreement to commit a crime. See United States v. Moore, 525 F.3d 1033, 1040 (11th Cir. 2008). Specifically, a jury may find an agreement based on “the conduct of the alleged participants” or other “circumstantial evidence of a scheme.” Silvestri, 409 F.3d at 1328 (quotations omitted).C. Evidence Supporting Cladek’s Conspiracy Conviction

Cladek contends that the government failed to prove the existence of an agreement between herself and someone else to accomplish an unlawful objective. Cladek’s argument fails because a reasonable jury could readily infer that the head

The jury convicted Cladek of conspiracy to commit mail and wire fraud. Thus, the jury found that the government proved the following elements beyond a reasonable doubt: (1) “an agreement between two or more persons”; (2) “to execute a scheme to defraud”; and (3) “the use of either the mails or wire service in furtherance of the scheme.” United States v. Ross, 131 F.3d 970, 981 (11th Cir. 1997).

Because conspiracy is “predominantly mental in composition,” there need not be “a formal agreement” between co-conspirators as long as there is “a meeting of the minds to commit an unlawful act.” United States v. Toler, 144 F.3d 1423, 1426 (11th Cir. 1998) (quotations omitted). To that end, a jury may use circumstantial evidence to infer the existence of an agreement to commit a crime. See United States v. Moore, 525 F.3d 1033, 1040 (11th Cir. 2008). Specifically, a jury may find an agreement based on “the conduct of the alleged participants” or other “circumstantial evidence of a scheme.” Silvestri, 409 F.3d at 1328 (quotations omitted).C. Evidence Supporting Cladek’s Conspiracy Conviction

Cladek contends that the government failed to prove the existence of an agreement between herself and someone else to accomplish an unlawful objective. Cladek’s argument fails because a reasonable jury could readily infer that the head

12

Case: 13-10024 Date Filed: 09/22/2014 Page: 13 of 26

of LCI’s accounting department, Reyes, knew of LCI’s unlawful practices and agreed with Cladek to help LCI carry out this fraud.

The trial evidence established that Reyes was very familiar with LCI’s business model and finances. Reyes knew that LCI told investors that it would use their monies to purchase subprime auto loan notes. Reyes also knew that LCI was not doing this and was instead spending investor funds on Cladek’s personal expenses and investments. Reyes was aware LCI was spending its money this way because she was the one cutting LCI’s checks. Reyes also was aware of what she was not being instructed to cut checks for—the purchase of new auto loan notes. Thus, Reyes’s testimony established that she was aware that LCI was misleading its investors about how it would use their investments. From Reyes’s knowledge, a reasonable jury could infer that Reyes agreed to help Cladek mislead investors.

Reyes’s testimony further established that she was aware of and indeed facilitated LCI’s efforts to conceal its fraud. When LCI did not have enough collateral to back all of the promissory notes it issued, Reyes personally assigned collateral doubly and prepared statements reflecting the double assignments. Reyes was the primary person responsible for putting the double assignment scheme into effect, testifying that she personally chose which notes to assign doubly and made a record of which notes had been doubly assigned. Reyes’s co- worker, Kay Osgatharp, assisted Reyes with execution of these double assigments.

The trial evidence established that Reyes was very familiar with LCI’s business model and finances. Reyes knew that LCI told investors that it would use their monies to purchase subprime auto loan notes. Reyes also knew that LCI was not doing this and was instead spending investor funds on Cladek’s personal expenses and investments. Reyes was aware LCI was spending its money this way because she was the one cutting LCI’s checks. Reyes also was aware of what she was not being instructed to cut checks for—the purchase of new auto loan notes. Thus, Reyes’s testimony established that she was aware that LCI was misleading its investors about how it would use their investments. From Reyes’s knowledge, a reasonable jury could infer that Reyes agreed to help Cladek mislead investors.

Reyes’s testimony further established that she was aware of and indeed facilitated LCI’s efforts to conceal its fraud. When LCI did not have enough collateral to back all of the promissory notes it issued, Reyes personally assigned collateral doubly and prepared statements reflecting the double assignments. Reyes was the primary person responsible for putting the double assignment scheme into effect, testifying that she personally chose which notes to assign doubly and made a record of which notes had been doubly assigned. Reyes’s co- worker, Kay Osgatharp, assisted Reyes with execution of these double assigments.

13

Case: 13-10024 Date Filed: 09/22/2014 Page: 14 of 26

Reyes also stopped sending out quarterly statements to investors, thus ensuring that LCI would not issue two statements at the same time reflecting the double assignments. Reyes did all of this even though she knew that LCI warranted to investors that the auto loan notes serving as collateral were free of other encumbrances.

Further, Reyes knew that the double assignment of collateral was not a legitimate business strategy to get LCI out of short-term financial difficulty. Reyes testified that LCI had insufficient collateral from 2003 until 2010 and that the gap between LCI’s obligations and its collateral continued to grow during that period. Over the course of seven years, Reyes did not take any legitimate measures to fix the problem of which she was fully aware. Instead, she acted to conceal it from investors. A reasonable jury could infer, from Reyes’s testimony about her actions, that she was not merely an unwitting dupe when she took carefully calibrated steps to conceal LCI’s fraud. Instead, a reasonable jury could conclude that Reyes had knowingly agreed with Cladek to take these concealment actions.

Reyes’s later actions even more strongly showed her agreement with Cladek to commit fraud. Reyes testified that she was aware that the Florida OFR was investigating LCI in 2008 and 2009. Reyes even assisted Cladek in preparing documents to turn over to the state agency and in pulling some documents back from LCI’s production.

Further, Reyes knew that the double assignment of collateral was not a legitimate business strategy to get LCI out of short-term financial difficulty. Reyes testified that LCI had insufficient collateral from 2003 until 2010 and that the gap between LCI’s obligations and its collateral continued to grow during that period. Over the course of seven years, Reyes did not take any legitimate measures to fix the problem of which she was fully aware. Instead, she acted to conceal it from investors. A reasonable jury could infer, from Reyes’s testimony about her actions, that she was not merely an unwitting dupe when she took carefully calibrated steps to conceal LCI’s fraud. Instead, a reasonable jury could conclude that Reyes had knowingly agreed with Cladek to take these concealment actions.

Reyes’s later actions even more strongly showed her agreement with Cladek to commit fraud. Reyes testified that she was aware that the Florida OFR was investigating LCI in 2008 and 2009. Reyes even assisted Cladek in preparing documents to turn over to the state agency and in pulling some documents back from LCI’s production.

14

Case: 13-10024 Date Filed: 09/22/2014 Page: 15 of 26

Reyes also attended the meeting in 2009 during which Cladek told her employees what to say to angry investors who called wanting to withdraw their investments. Reyes heard Cladek say that employees should tell investors that LCI had experienced “unprecedented success.” Reyes knew that this was a lie since she had become aware of LCI’s financial troubles six years earlier, in 2003.

Thus, at least by early 2009, Reyes was aware that a government agency thought LCI’s business practices may be fraudulent and that Cladek wanted employees to lie to investors about LCI’s financial condition. Nonetheless, Reyes continued to doubly assign collateral and cut checks payable to Cladek’s personal account up until LCI stopped its operations in 2010. A reasonable jury could believe that Reyes did so pursuant to an agreement with Cladek.

Last, a reasonable jury could infer an agreement between Cladek and Reyes based on their close relationship. Reyes and her mother were among LCI’s very first employees. For almost a decade, Reyes was intimately involved in LCI’s operations. Her testimony revealed that she had a very close working relationship with Cladek. A reasonable jury could find it difficult, if not impossible, to believe that, over a ten year period, Reyes could work so closely with a fraudster like Cladek, helping Cladek steal investors’ money and then conceal the fraud, and yet never agree to participate in the scheme.

Thus, at least by early 2009, Reyes was aware that a government agency thought LCI’s business practices may be fraudulent and that Cladek wanted employees to lie to investors about LCI’s financial condition. Nonetheless, Reyes continued to doubly assign collateral and cut checks payable to Cladek’s personal account up until LCI stopped its operations in 2010. A reasonable jury could believe that Reyes did so pursuant to an agreement with Cladek.

Last, a reasonable jury could infer an agreement between Cladek and Reyes based on their close relationship. Reyes and her mother were among LCI’s very first employees. For almost a decade, Reyes was intimately involved in LCI’s operations. Her testimony revealed that she had a very close working relationship with Cladek. A reasonable jury could find it difficult, if not impossible, to believe that, over a ten year period, Reyes could work so closely with a fraudster like Cladek, helping Cladek steal investors’ money and then conceal the fraud, and yet never agree to participate in the scheme.

15

Case: 13-10024 Date Filed: 09/22/2014 Page: 16 of 26

In short, there was more than enough evidence for a reasonable jury to find that Cladek formed an agreement with another person, Reyes, to commit mail and wire fraud. We thus reject Cladek’s challenge to her conspiracy conviction.

III. CLADEK’S SENTENCE

Cladek raises two challenges to her total 365-month sentence. We review the proceedings in the district court culminating in the sentence.A. The Presentence Investigation Report

Prior to sentencing, the probation office prepared a presentence investigation report (“PSI”). The PSI stated that Cladek was responsible for a loss of approximately $69 million. To reach this figure, the PSI reported that LCI received approximately $112 million from investors between 2005 and March 2010 (the conspiracy period alleged). From this amount, the PSI subtracted a total of $43 million, representing $39 million in payments made to investors and $4 million for LCI’s assets when its operations ceased.

Starting with a base offense level of six, see U.S.S.G. § 2B1.1(a)(2), the PSI added (1) 24 levels because Cladek’s loss amount was greater than $50 million and less than $100 million, pursuant to § 2B1.1(b)(1)(M); (2) six levels, pursuant to

§ 2B1.1(b)(2)(C), because Cladek’s offense involved more than 250 victims; and (3) four levels because Cladek was the organizer or leader of a “criminal activity

III. CLADEK’S SENTENCE

Cladek raises two challenges to her total 365-month sentence. We review the proceedings in the district court culminating in the sentence.A. The Presentence Investigation Report

Prior to sentencing, the probation office prepared a presentence investigation report (“PSI”). The PSI stated that Cladek was responsible for a loss of approximately $69 million. To reach this figure, the PSI reported that LCI received approximately $112 million from investors between 2005 and March 2010 (the conspiracy period alleged). From this amount, the PSI subtracted a total of $43 million, representing $39 million in payments made to investors and $4 million for LCI’s assets when its operations ceased.

Starting with a base offense level of six, see U.S.S.G. § 2B1.1(a)(2), the PSI added (1) 24 levels because Cladek’s loss amount was greater than $50 million and less than $100 million, pursuant to § 2B1.1(b)(1)(M); (2) six levels, pursuant to

§ 2B1.1(b)(2)(C), because Cladek’s offense involved more than 250 victims; and (3) four levels because Cladek was the organizer or leader of a “criminal activity

16

Case: 13-10024 Date Filed: 09/22/2014 Page: 17 of 26

that involved five or more participants or was otherwise extensive,” pursuant to § 3B1.1(a). Cladek’s total offense level, therefore, was 40.

Cladek’s criminal history category of I and total offense level of 40 produced an advisory guidelines range of 292 to 365 months’ imprisonment. Because the highest statutory maximum penalty for Cladek’s offenses was 240 months’ imprisonment, the PSI recommended that the sentence on one of Cladek’s offenses be imposed consecutively to the extent necessary to produce a combined sentence equal to the total punishment called for by the guidelines. See id.

§ 5G1.2(d).B. Cladek’s Objection to the Loss Amount

At sentencing, Cladek objected to the PSI’s calculation of the loss amount enhancement. First, Cladek argued that the PSI’s loss amount was inaccurate because it did not take into account “non-criminal acts that resulted in the loss to the company”—specifically the economic downturn during the 2007 to 2009 period. Cladek’s attorney urged that Cladek’s estimated gain of $16.7 million, rather than the amount of loss she caused, should be used to calculate her offense level. See id. § 2B1.1, app. n.3(B).

Cladek also contended that the PSI was incorrect in stating that LCI received approximately $112 million from investors between 2005 and 2010. Cladek’s

Cladek’s criminal history category of I and total offense level of 40 produced an advisory guidelines range of 292 to 365 months’ imprisonment. Because the highest statutory maximum penalty for Cladek’s offenses was 240 months’ imprisonment, the PSI recommended that the sentence on one of Cladek’s offenses be imposed consecutively to the extent necessary to produce a combined sentence equal to the total punishment called for by the guidelines. See id.

§ 5G1.2(d).B. Cladek’s Objection to the Loss Amount

At sentencing, Cladek objected to the PSI’s calculation of the loss amount enhancement. First, Cladek argued that the PSI’s loss amount was inaccurate because it did not take into account “non-criminal acts that resulted in the loss to the company”—specifically the economic downturn during the 2007 to 2009 period. Cladek’s attorney urged that Cladek’s estimated gain of $16.7 million, rather than the amount of loss she caused, should be used to calculate her offense level. See id. § 2B1.1, app. n.3(B).

Cladek also contended that the PSI was incorrect in stating that LCI received approximately $112 million from investors between 2005 and 2010. Cladek’s

17

Case: 13-10024 Date Filed: 09/22/2014 Page: 18 of 26

attorney noted that the government’s trial evidence, specifically LCI’s bank records, showed that LCI received approximately $90 million in investments.

The government responded that the $112 million figure was “arrived at by reference to Lydia Cladek’s own accounting documents which she created to send to her accountant.” Acknowledging the discrepancy between the PSI and the trial evidence, the government stated that the $90 million figure introduced at trial was “a conservative [estimate]” that was “based entirely upon bank records,” and did not take into account the balance sheets Cladek created. The government maintained that the $112 million figure was actually correct.1 As for Cladek’s argument about “legitimate business losses,” the government contended that LCI could not have suffered legitimate losses, as it “was not a legitimate business” and was instead a “scheme to defraud from the very beginning.”

The district court overruled Cladek’s objections to the amount of the loss and the 24-level increase to her offense level. The district court found that LCI received an amount between $93 million and $112 million over the course of the fraud. After subtracting the $39 million paid to investors and the $4 million

1The district court also called on the probation officer to explain the discrepancy between the PSI’s $112 million investment amount and the trial evidence’s $90 million figure. The probation officer stated that the PSI’s figure was based on the 2,443 promissory notes LCI issued, and thus represented “the total investments pledged.” On the other hand, LCI’s bank records for that period showed only $90 million in deposits. The probation officer could not account for the $22 million variation.

The government responded that the $112 million figure was “arrived at by reference to Lydia Cladek’s own accounting documents which she created to send to her accountant.” Acknowledging the discrepancy between the PSI and the trial evidence, the government stated that the $90 million figure introduced at trial was “a conservative [estimate]” that was “based entirely upon bank records,” and did not take into account the balance sheets Cladek created. The government maintained that the $112 million figure was actually correct.1 As for Cladek’s argument about “legitimate business losses,” the government contended that LCI could not have suffered legitimate losses, as it “was not a legitimate business” and was instead a “scheme to defraud from the very beginning.”

The district court overruled Cladek’s objections to the amount of the loss and the 24-level increase to her offense level. The district court found that LCI received an amount between $93 million and $112 million over the course of the fraud. After subtracting the $39 million paid to investors and the $4 million

1The district court also called on the probation officer to explain the discrepancy between the PSI’s $112 million investment amount and the trial evidence’s $90 million figure. The probation officer stated that the PSI’s figure was based on the 2,443 promissory notes LCI issued, and thus represented “the total investments pledged.” On the other hand, LCI’s bank records for that period showed only $90 million in deposits. The probation officer could not account for the $22 million variation.

18

Case: 13-10024 Date Filed: 09/22/2014 Page: 19 of 26

leftover when LCI ceased operations, the district court arrived at a loss amount of greater than $50 million and less than or equal to $69 million.

The district court explained that it believed this greater than $93 million figure to be “a reasonable number” because it “capture[d] what Ms. Cladek was promising . . . to investors . . . . And then . . . the $39 million figure shows what was actually paid out. And then the $4 million figure is what was left at the time the business was raided.” The district court reiterated that its loss amount was only “a reasonable estimate” and “a construct.” In light of this loss amount, the district court determined that the PSI correctly added 24 levels to Cladek’s offense level.2C. Cladek’s Objection to the Role Increase

Cladek’s other objection at issue in this appeal was to the four-level increase, pursuant to U.S.S.G. § 3B1.1(a), for being the organizer or leader of a criminal activity involving five or more participants “or that was otherwise extensive.” (emphasis added) Cladek’s attorney argued that Cladek’s scheme did not “require any additional work other than Ms. Cladek . . . just transferring funds from LCI into the professional account, making purchases of property.” He suggested, “That doesn’t require any extensive action on anybody’s part.”

2The district court did state that it rejected the government’s position that LCI was never a legitimate business. However, the rejection of this argument did not factor into the district court’s guidelines calculation or sentence.

The district court explained that it believed this greater than $93 million figure to be “a reasonable number” because it “capture[d] what Ms. Cladek was promising . . . to investors . . . . And then . . . the $39 million figure shows what was actually paid out. And then the $4 million figure is what was left at the time the business was raided.” The district court reiterated that its loss amount was only “a reasonable estimate” and “a construct.” In light of this loss amount, the district court determined that the PSI correctly added 24 levels to Cladek’s offense level.2C. Cladek’s Objection to the Role Increase

Cladek’s other objection at issue in this appeal was to the four-level increase, pursuant to U.S.S.G. § 3B1.1(a), for being the organizer or leader of a criminal activity involving five or more participants “or that was otherwise extensive.” (emphasis added) Cladek’s attorney argued that Cladek’s scheme did not “require any additional work other than Ms. Cladek . . . just transferring funds from LCI into the professional account, making purchases of property.” He suggested, “That doesn’t require any extensive action on anybody’s part.”

2The district court did state that it rejected the government’s position that LCI was never a legitimate business. However, the rejection of this argument did not factor into the district court’s guidelines calculation or sentence.

19

Case: 13-10024 Date Filed: 09/22/2014 Page: 20 of 26

The district court denied this objection as well. The district court pointed out that, in determining whether a criminal activity is extensive, it could consider “all persons involved during the course of the entire offense . . . , including outsiders who provided unknowing services.” The district court noted that the government needed to prove the existence of at least one other knowing participant and found that the evidence established “Ms. Reyes’[s] conspiratorial participation.” Further, the district court acknowledged that “there may well have been others who could have been unindicted co-conspirators.”D. Sentence

Based on these rulings, the district court determined that the PSI correctly calculated Cladek’s total offense level of 40, her criminal history category of I, and her advisory guidelines range of 292 to 365 months. In light of “the amount of loss” and “the brazenness of” Cladek’s crimes, “the lack of insight, . . . [and] concern for future potential criminal conduct,” the district court determined that “a significant sentence is required by law.”

The district court imposed concurrent sentences of 240 months’ imprisonment on thirteen of Cladek’s offenses and a consecutive sentence of 125 months’ imprisonment on Cladek’s fourteenth offense, resulting in a total 365- month sentence. The district court followed the same procedure when it sentenced Cladek to supervised release, imposing concurrent three-year supervised release

Based on these rulings, the district court determined that the PSI correctly calculated Cladek’s total offense level of 40, her criminal history category of I, and her advisory guidelines range of 292 to 365 months. In light of “the amount of loss” and “the brazenness of” Cladek’s crimes, “the lack of insight, . . . [and] concern for future potential criminal conduct,” the district court determined that “a significant sentence is required by law.”

The district court imposed concurrent sentences of 240 months’ imprisonment on thirteen of Cladek’s offenses and a consecutive sentence of 125 months’ imprisonment on Cladek’s fourteenth offense, resulting in a total 365- month sentence. The district court followed the same procedure when it sentenced Cladek to supervised release, imposing concurrent three-year supervised release

20

Case: 13-10024 Date Filed: 09/22/2014 Page: 21 of 26

terms on thirteen of Cladek’s offenses, followed by a consecutive three-year supervised release term on Cladek’s fourteenth offense, yielding a total of six years of supervised release.

IV. SENTENCING ISSUES

On appeal, Cladek argues that the district court erred in overruling her objections to the loss amount and role increases in her offense level calculation. As explained below, Cladek’s arguments fail.

We review de novo the district court’s interpretation and application of the guidelines. United States v. Lee, 427 F.3d 881, 892 (11th Cir. 2005). We review only for clear error the factual findings the district court used to calculate a defendant’s guidelines range, such as loss amount or whether the defendant was subject to a role increase. Id.; see also United States v. Martinez, 584 F.3d 1022, 1025 (11th Cir. 2009); United States v. Maxwell, 579 F.3d 1282, 1305 (11th Cir. 2009).A. Loss Amount Enhancement

Under U.S.S.G. § 2B1.1(b)(1), in fraud cases like Cladek’s, 24 levels are added to a defendant’s offense level when the loss is greater than $50 million and less than $100 million. U.S.S.G. § 2B1.1(b)(1). “Loss” refers to the greater of “actual loss or intended loss.” Id., cmt. n.3(A). Here, the district court determined

IV. SENTENCING ISSUES

On appeal, Cladek argues that the district court erred in overruling her objections to the loss amount and role increases in her offense level calculation. As explained below, Cladek’s arguments fail.

We review de novo the district court’s interpretation and application of the guidelines. United States v. Lee, 427 F.3d 881, 892 (11th Cir. 2005). We review only for clear error the factual findings the district court used to calculate a defendant’s guidelines range, such as loss amount or whether the defendant was subject to a role increase. Id.; see also United States v. Martinez, 584 F.3d 1022, 1025 (11th Cir. 2009); United States v. Maxwell, 579 F.3d 1282, 1305 (11th Cir. 2009).A. Loss Amount Enhancement

Under U.S.S.G. § 2B1.1(b)(1), in fraud cases like Cladek’s, 24 levels are added to a defendant’s offense level when the loss is greater than $50 million and less than $100 million. U.S.S.G. § 2B1.1(b)(1). “Loss” refers to the greater of “actual loss or intended loss.” Id., cmt. n.3(A). Here, the district court determined

21

Case: 13-10024 Date Filed: 09/22/2014 Page: 22 of 26

Cladek’s actual loss, which refers to “the reasonably foreseeable pecuniary harm that resulted from the offense.” Id., cmt. n.3(A)(i).

A district court “need only make a reasonable estimate of the loss,” as that court “is in a unique position to assess the evidence and estimate the loss based upon that evidence.” Id., cmt. n.3(C); See United States v. Campbell, ___ F.3d ___, 12-11952, 2014 WL 4338404 at *12 (11th Cir. Sept. 3, 2014) (affirming district court’s loss calculation under the Sentencing Guidelines). Accordingly, this Court must give deference to a district court’s loss calculation, and a district court’s “reasonable estimate . . . will be upheld on appeal.” United States v. Gupta, 463 F.3d 1182, 1200 (11th Cir. 2006) (quotations omitted). However, a district court may not base a loss calculation on “mere speculation.” Id. Instead, the district court “must make factual findings sufficient to support the government’s claim of the amount of fraud loss attributed to a defendant in a PSI.” Id.

Here, the district court made factual findings sufficient to support its determination that Cladek’s loss was greater than $50 million and less than or equal to $69 million. The district court explained the figures and calculations it used to reach the loss amount. Of course, there was some uncertainty at sentencing as to how much money LCI received from investors. However, the district court found that, even assuming that the number was as low as one dollar more than $93

A district court “need only make a reasonable estimate of the loss,” as that court “is in a unique position to assess the evidence and estimate the loss based upon that evidence.” Id., cmt. n.3(C); See United States v. Campbell, ___ F.3d ___, 12-11952, 2014 WL 4338404 at *12 (11th Cir. Sept. 3, 2014) (affirming district court’s loss calculation under the Sentencing Guidelines). Accordingly, this Court must give deference to a district court’s loss calculation, and a district court’s “reasonable estimate . . . will be upheld on appeal.” United States v. Gupta, 463 F.3d 1182, 1200 (11th Cir. 2006) (quotations omitted). However, a district court may not base a loss calculation on “mere speculation.” Id. Instead, the district court “must make factual findings sufficient to support the government’s claim of the amount of fraud loss attributed to a defendant in a PSI.” Id.

Here, the district court made factual findings sufficient to support its determination that Cladek’s loss was greater than $50 million and less than or equal to $69 million. The district court explained the figures and calculations it used to reach the loss amount. Of course, there was some uncertainty at sentencing as to how much money LCI received from investors. However, the district court found that, even assuming that the number was as low as one dollar more than $93

22

Case: 13-10024 Date Filed: 09/22/2014 Page: 23 of 26

million, the guidelines calculation would be the same. In light of the evidence of LCI’s income—gleaned from LCI’s own business records—the district court had a reasonable basis for finding that LCI received greater than $93 million from investors, and we therefore must defer to the district court’s loss calculation. See id.

Cladek argues that the district court should have measured loss by looking to the gain Cladek received—money diverted from LCI to her personal account (which at sentencing she estimated was $16.7 million). But, a defendant’s gain should be used as a substitute “only if there is a loss but it reasonably cannot be determined.” U.S.S.G. § 2B1.1, cmt. n.3(B) (emphasis added). This Court has “cautioned against abandoning a loss calculation in favor of a gain calculation where a reasonable estimate of the victims’ loss based on existing information is feasible.” United States v. Bradley, 644 F.3d 1213, 1289 (11th Cir. 2011) (quotation marks omitted, alterations adopted). We have done so because a defendant’s gain “ordinarily underestimates the loss.” Id.

Here, Cladek has not shown that it was infeasible to calculate the investors’ loss she caused. Cladek contends that the district court’s figure failed to take into account legitimate business losses and that it double counted money that was never withdrawn and reinvested when a promissory note matured. But, Cladek does not state the extent of LCI’s market-inflicted losses, nor how much money was double

Cladek argues that the district court should have measured loss by looking to the gain Cladek received—money diverted from LCI to her personal account (which at sentencing she estimated was $16.7 million). But, a defendant’s gain should be used as a substitute “only if there is a loss but it reasonably cannot be determined.” U.S.S.G. § 2B1.1, cmt. n.3(B) (emphasis added). This Court has “cautioned against abandoning a loss calculation in favor of a gain calculation where a reasonable estimate of the victims’ loss based on existing information is feasible.” United States v. Bradley, 644 F.3d 1213, 1289 (11th Cir. 2011) (quotation marks omitted, alterations adopted). We have done so because a defendant’s gain “ordinarily underestimates the loss.” Id.

Here, Cladek has not shown that it was infeasible to calculate the investors’ loss she caused. Cladek contends that the district court’s figure failed to take into account legitimate business losses and that it double counted money that was never withdrawn and reinvested when a promissory note matured. But, Cladek does not state the extent of LCI’s market-inflicted losses, nor how much money was double

23

Case: 13-10024 Date Filed: 09/22/2014 Page: 24 of 26

counted. She simply asserts that the district court should have used the $16.7 million gain figure as a proxy for a loss that could not be calculated. But, even assuming that there were some legitimate business losses and some double counting, nothing in the record suggests that these factors caused the district court’s loss calculation of approximately $69 million to be off by more than $50 million (the difference between the district court’s loss amount and Cladek’s gain amount). Thus, this is an example of a case where the defendant’s gain “underestimates the loss.” See id.

Accordingly, we must defer to the district court’s analysis. While the issues Cladek raises may suggest de minimus discrepancies, they do not make the district court’s calculation of Cladek’s loss amount anything other than a “reasonable estimate.” See U.S.S.G. § 2B1.1, cmt. n.3(C).

We conclude that the district court did not err—much less clearly err—in its fact findings and loss calculations and in increasing Cladek’s offense level by 24 levels pursuant to § 2B1.1.B. Role Increase

Under § 3B1.1, a defendant’s offense level is subject to a four-level increase when she “was an organizer or leader of a criminal activity that involved five or more participants or was otherwise extensive.” U.S.S.G. § 3B1.1(a). The district

Accordingly, we must defer to the district court’s analysis. While the issues Cladek raises may suggest de minimus discrepancies, they do not make the district court’s calculation of Cladek’s loss amount anything other than a “reasonable estimate.” See U.S.S.G. § 2B1.1, cmt. n.3(C).

We conclude that the district court did not err—much less clearly err—in its fact findings and loss calculations and in increasing Cladek’s offense level by 24 levels pursuant to § 2B1.1.B. Role Increase

Under § 3B1.1, a defendant’s offense level is subject to a four-level increase when she “was an organizer or leader of a criminal activity that involved five or more participants or was otherwise extensive.” U.S.S.G. § 3B1.1(a). The district

24

Case: 13-10024 Date Filed: 09/22/2014 Page: 25 of 26

court found that Cladek was the organizer or leader of an “otherwise extensive” criminal activity.

To receive a role increase under § 3B1.1, the defendant must have been the organizer or leader of at least one or more criminally responsible participants. Id., cmt. nn.1–2. But, that criminally responsible participant “need not have been convicted.” Id., cmt. n.1. In determining whether a criminal activity was “otherwise extensive,” once a court determines that there was at least one criminally responsible participant, the court may take into account “all persons involved during the course of the entire offense,” including outsiders who provided “unknowing services.” Id., cmt. n.3.

The district court did not clearly err in applying the § 3B1.1 role increase. There was ample evidence to establish that Reyes was a participant in Cladek’s fraud. As discussed, a reasonable jury could find, based on the trial evidence, that Reyes formed an agreement with Cladek to accomplish an unlawful objective.

Once it was satisfied that Cladek was the leader of at least one criminally responsible participant (Reyes), the district court could consider that there were more than 100 LCI employees who provided “unknowing services” in furtherance of Cladek’s fraud. Furthermore, LCI’s scheme was massive both in duration and scope, involving the receipt of millions of dollars from investors over a ten-year period. See United States v. Holland, 22 F.3d 1040, 1046 (11th Cir. 1994)

To receive a role increase under § 3B1.1, the defendant must have been the organizer or leader of at least one or more criminally responsible participants. Id., cmt. nn.1–2. But, that criminally responsible participant “need not have been convicted.” Id., cmt. n.1. In determining whether a criminal activity was “otherwise extensive,” once a court determines that there was at least one criminally responsible participant, the court may take into account “all persons involved during the course of the entire offense,” including outsiders who provided “unknowing services.” Id., cmt. n.3.

The district court did not clearly err in applying the § 3B1.1 role increase. There was ample evidence to establish that Reyes was a participant in Cladek’s fraud. As discussed, a reasonable jury could find, based on the trial evidence, that Reyes formed an agreement with Cladek to accomplish an unlawful objective.

Once it was satisfied that Cladek was the leader of at least one criminally responsible participant (Reyes), the district court could consider that there were more than 100 LCI employees who provided “unknowing services” in furtherance of Cladek’s fraud. Furthermore, LCI’s scheme was massive both in duration and scope, involving the receipt of millions of dollars from investors over a ten-year period. See United States v. Holland, 22 F.3d 1040, 1046 (11th Cir. 1994)

25

Case: 13-10024 Date Filed: 09/22/2014 Page: 26 of 26

(holding “there are a number of factors relevant to the extensiveness determination, including the length and scope of the criminal activity as well as the number of persons involved”). We cannot fathom how such a scheme could be labeled as anything other than “extensive.”

Thus, we affirm the district court’s application of the four-level increase under § 3B1.1.

V. CONCLUSION

Based on the foregoing, we affirm Cladek’s convictions and 365-month sentence. However, we vacate the consecutive three-year term of supervised release on Count Fourteen and direct the district court on remand to amend Cladek’s sentence to state that the three-year term of supervised release on Count Fourteen shall run concurrently with the supervised release terms on Counts One through Thirteen already imposed concurrently. See 18 U.S.C. § 3624(e); United States v. Magluta, 198 F.3d 1265, 1283 (11th Cir. 1999), vacated in part on reh’g, 203 F.3d 1304 (11th Cir. 2000) (“As Magluta and the government correctly point out, ‘any term of supervised release imposed is to run concurrently with any other term of supervised release imposed.’ ” (citing § 3624(e))); U.S.S.G., App. C, amend. 507 (stating that § 3624(e) “requires multiple terms of supervised release to run concurrently in all cases”).

AFFIRMED IN PART, VACATED IN PART, AND REMANDED.

Thus, we affirm the district court’s application of the four-level increase under § 3B1.1.

V. CONCLUSION

Based on the foregoing, we affirm Cladek’s convictions and 365-month sentence. However, we vacate the consecutive three-year term of supervised release on Count Fourteen and direct the district court on remand to amend Cladek’s sentence to state that the three-year term of supervised release on Count Fourteen shall run concurrently with the supervised release terms on Counts One through Thirteen already imposed concurrently. See 18 U.S.C. § 3624(e); United States v. Magluta, 198 F.3d 1265, 1283 (11th Cir. 1999), vacated in part on reh’g, 203 F.3d 1304 (11th Cir. 2000) (“As Magluta and the government correctly point out, ‘any term of supervised release imposed is to run concurrently with any other term of supervised release imposed.’ ” (citing § 3624(e))); U.S.S.G., App. C, amend. 507 (stating that § 3624(e) “requires multiple terms of supervised release to run concurrently in all cases”).

AFFIRMED IN PART, VACATED IN PART, AND REMANDED.

26

No comments:

Post a Comment