Has a succession of insouciant profit-maximizing oligoplists has ruined the St. Augustine Record?

No more interviews of candidates, little interest in uncovering corruption, shallow surface coverage, with a USA Today layout.

The Record was founded by Henry Flagler's frontman, the grandfather of the late St. Augustine real estate speculator Pierre Thompson.

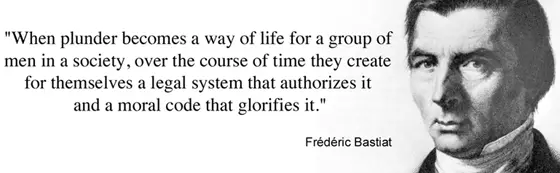

Then a railroad owned it, and then, 1981-2017, MORRIS COMMUNICATIONS. MORRIS went bankrupt in 2011, forgiven $300,000,000 in debt. after making colossal financial errors, reducing news coverage in Our Nation;s Oldest City.

Judith Seraphin and I warned in 2011 that without investigative reporting the Record's owners would go bankrupt again.

After the banruptcy, right-wing Dull Republicans at MORRIS sold their mismanaged newspapers to profit-taking GATEHOUSE, which then merged with GANNETT.

They retained the Record building, which was just sold (buyer not disclosed!)

GANNETT has now shed another 500 employees through buyouts -- 60 editors, 19 photojournalists, seven managing editors, three executive editors and 124 reporters.

GANNETT's stock price is currently $1.71 per share, up from 65 cents a share earlier this year -- that was almost penny stock range.

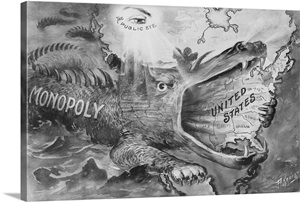

GANNETT is most noted for its oligooply -- the Nation's largest newspaper publisher, with 25% of the market -- oligopoly under requiring antitrust law scrutiny.

Wikipedia reports, "Through a series of investment firms, Gannett is partially owned by Japanese conglomerate Softbank."

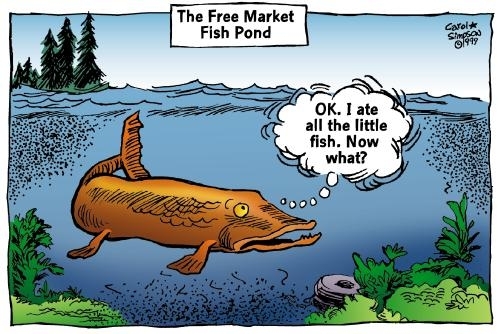

GANNETT is a devoted devourer of hundreds of local newspapers. The Nashville Tennessean was a great newspaper before GANNETT bought it. GANNETT wrings profits out of properties and transmogrifies them into McPapers, closely resembling USA Today.

Shallow papers that don't investigate local wrongdoing -- louche lapdogs, not watchdogs. Pitiful.

What is to be done?

You tell me.

St. Augustine deserves a real newspaper.

From Poynter Institute:

About 500 people are taking buyouts at Gannett

The offer, extended to all of Gannett's 21,000 employees, was first introduced in October

By: Kristen Hare and Rick Edmonds

November 12, 2020

In October, Gannett offered a round of voluntary buyouts to all its employees. Poynter has learned that roughly 600 people opted in and roughly 500 buyouts were accepted.

Gannett, which owns USA Today and more than 250 daily newsrooms, is the country’s largest newspaper owner. It employs about 21,000 people, 5,000 of them journalists.

Poynter obtained a copy of a 15-page PDF listing of the job titles of those selected for buyouts. We’re not publishing it here because it contains identifying details about people who took buyouts and people whose offers were not accepted.

The buyouts include about 60 editors, 19 photojournalists, seven managing editors, three executive editors and 124 reporters.

In the spring, Gannett laid off journalists around the country after its merger with Gatehouse.

In late summer, the company told financial analysts in an earnings conference call that it planned a net addition of journalists through the second half of the year.

Because of the coronavirus, Gannett, like many other media companies, has had furloughs and pay cuts. It closed two newsrooms in Texas, closed printing presses in Montana and California and moved a newsroom out of its building in Ohio.

Gannett also has taken on the printing of newspapers of the locally owned Philadelphia Inquirer and McClatchy’s Kansas City Star.

A Gannett spokeswoman declined to confirm how many offers were extended and how many were accepted.

It is not clear whether some of the positions will be filled by promotions or new hires.

“Gannett’s furloughs earlier this year and the recent buyouts undermine our democracy,” said Jon Schleuss, president of The NewsGuild — Communications Workers of America. “It’s a disgrace that any news company thinks it can cut its way to success.”

Editor’s note: We have updated this story to include information about the documents used to source this story.

---------

Gannett stock has now fallen to 65 cents a share

It's an abrupt fall from the $12.06 New Media Investment offered last August as roughly half the payment to acquire the company.

By: Rick Edmonds

April 6, 2020

Gannett, the nation’s largest newspaper company with 261 daily papers including USA Today, watched its stock plunge further Monday to 65 cents a share at market close.

That’s an abrupt fall, to put it mildly, from the $12.06 GateHouse Media parent New Media Investment offered Aug. 5 as roughly half payment to acquire Gannett (retaining the Gannett name).

Shares had fallen by the time the deal closed Nov. 19, and the overall market had been in steep decline even before the pandemic began.

But not nearly steeply enough to send it into penny stock territory.

A similar loss of investor confidence, together with pension funding woes, was a big factor in forcing McClatchy — the second largest, with its 31 papers — to file for Chapter 11 bankruptcy protection Feb. 13. I wouldn’t expect Gannett to follow suit. Apollo Global Capital’s loan (debt taken on by New Media Investment to fund the deal) is for a five year period and, despite the stock plunge, the company is still profitable. And the merged company is just getting started.

Barring an apocalyptic scenario, things will get better.

But the news does highlight the huge gulf between Gannett’s plan to take advantage of greater scale for big savings and some new revenue streams and what may be possible now. Gannett is stuck with interest and paydown on the $1.2 billion financing from Apollo.

I don’t think a takeover bid is at all likely either.

Who would want an entrée into the industry, paying off Apollo and securing its own financing for the borrowing needed?

Billionaire investor Leon Cooperman pressed Gannett CEO Mike Reed on the point during the company’s last earnings conference call. By Cooperman’s math, Reed was promising the company could be worth five or six times as much in a few years as it is now. How could that possibly be? (And the shares were not doing nearly as badly then).

Reed stuck by an earlier statement that savings and revenue progress is in the works and that Gannett has steadily reduced its reliance on print advertising (now just 29% of total revenue). And, he said, the company is current on its loan obligation to Apollo.

I reached Reed Monday and he declined to say more on the record.

Added detail is likely to be forthcoming when the company gives a financial report on the quarter that just ended in another month to six weeks.

Gannett did do a round of furloughs and pay cuts a week ago, And as I had discussed earlier in a piece with my colleague Kelly McBride, all of its papers are taking down the paywall for all of their pandemic coverage, both fulfilling a public service mission and building equity with a paying audience.

Still, distress is distress. Even with lots of company in the industry and the broader economy, Gannett is experiencing an acute case.

Rick Edmonds is Poynter’s media business analyst. He can be reached at redmonds@poynter.org.

From Business Insider:

Gannett owes a hefty interest payment to private-equity giant Apollo in 2 months. It's just one of the world's biggest newspaper publisher's many mounting problems.

bsaacks@businessinsider.com (Bradley Saacks) 4/24/2020

o Gannett owes a hefty interest payment to private-equity giant Apollo in 2 months. It's just one of the world's biggest newspaper publisher's many mounting problems.

o Newspaper publisher Gannett's first payment to private-equity giant Apollo Global Management is due in two months.

o The company has furloughed hundreds of journalists and advertising revenue plummets due to the novel coronavirus pandemic.

o The terms of the loan require Gannett to: not miss a coupon payment; have $20 million in cash on hand at all times; and keep capital expenditures below $60 million annually.

o Gannett is one of several large media companies facing big challenges.

o McClatchy recently filed for Chapter 11 bankruptcy, and online publisher Vox furloughed dozens of writers.

When USA Today publisher Gannett and Fortress' New Media Investment Group last year accepted a five-year, $1.8 billion loan — with an eye-popping 11.5% interest — from Apollo to finance their merger, analysts were skeptical about how the newly combined company would be able to pay it back.

Publishers reliant on print advertising have faced an uphill battle as people now consume the vast majority of their news online, where tech giants Google and Facebook vacuum up most of the ad revenue.

Then, the coronavirus pandemic shuttered the global economy, forcing Gannett to furlough hundreds of journalists as advertising revenue plummets.

Gannett's most comparable peer, McClatchy, filed for bankruptcy and is likely to be run by its biggest lender, hedge fund Chatham Asset Management, after the bankruptcy proceedings. Online publisher Vox has furloughed dozens of writers across its sites, and smaller publications like The Information, Protocol, and Adweek all had layoffs.

Now, with the first loan payment due in roughly two months, the world's largest publisher of newspapers has already suspended dividend payments for the first and second quarters.

"Down the road, we could see both the 'D' and 'B' words arise. Default, on the loan obligation. Bankruptcy, as in Gannett's inability to go forward given the twin pressures of its debt and advertising depression," wrote Ken Doctor, a media analyst, on a blog run by Harvard's Nieman Lab.

The interest rate was "freaking onerous" when the loan was first announced, said Doug Arthur, an analyst at Huber Research Partners who covers Gannett and other media companies. Now, "it's crushing."

"It's a ticking time bomb and results for 2020 are going to be brutal."

Gannett declined to say if it will ask Apollo for an extension on the loan. Apollo also declined to comment on the loan.

Gannett's choices

There are three ways Gannett can default on the loan if the company does not make its coupon payments; if the company does not keep $20 million cash on hand at all times; and if the company spends more than $60 million on capital expenditures in a year.

Each coupon payment is expected to be hundreds of millions of dollars, and Gannett is hoping to find $300 million worth of synergies from the merger in the next two years, according to the firm's most recent earnings report.

The company had $156 million in cash as of the end of fourth quarter.

The firm notes it plans to refinance the loan from Apollo at the end of 2021 when the leverage is lower. The company also plans to add another $100 million to $125 million to pay down debt through real estate sales this year and next, but Arthur questions how much more the company can sell.

"They've already sold a lot, and now the market has completely turned. Who wants to buy a building in downtown Des Moines right now?" he said.

"They'll do everything they can right now. They'll combine every plant, they'll make huge cuts. It's not impossible, but it's dicey."

One of the company's biggest investors has soured on the business in light of the pandemic. Billionaire Leon Cooperman, who turned his hedge fund Omega Advisors into a family office at the end of 2018, sold more than 3 million shares at a loss, and told Business Insider that "the virus hit them hard and I reduced my position. Nothing more insightful than that."

No comments:

Post a Comment