Looking forward to someone writing a definitive corporaate history of GANNETT, perhaps with a title as evocative as the Pennsylvania Railroad corporate history, Ride the Pennsy to Ruin.

From Poynter Institute:

Revenues are still declining, but Gannett insists it is meeting its digital goals

The newspaper chain grew digital subscriptions to 1.6 million but the surge appears to be driven by deeply discounted introductory rates.

Gannett reported its financial results for the fourth quarter of 2021 Thursday. It was a decidedly mixed bag. Digital-only subscriptions had grown to 1.6 million by the end of the year, and roughly a third of its revenues came from various digital ventures.

On the other hand, total revenue for the quarter was $827 million, down from $875 million during the same period in 2020, a 5.5% decline. Print advertising was off by more than 10%, but circulation revenue fell, too.

That indicates that print subscription revenue is falling away faster than the new revenue generated from digital-only subscriptions.

As I wrote earlier when Lee Enterprises reported big gains in digital subscriptions, Gannett’s surge appears to be driven by deeply discounted introductory rates. Revenues did not grow nearly as much year-to-year as the number of subscriptions — 26% vs. 49%. Average revenue per subscription is a bit more than $60 per year.

So as Gannett targets reaching 2 to 2.2 million digital subscriptions by the end of 2022, it faces the double challenge of holding the introductory subscribers as they move up to higher rates while also continuing to quickly add new subscribers.

CEO Mike Reed told analysts on a conference call that it will take several more years to get revenues headed up and then growth will continue. Meanwhile, the company is increasingly profitable on a cash basis and has been paying down and refinancing at lower interest rates the debt it took on when Gannett and the GateHouse chain merged in November 2019.

On a standard accounting basis, though, the company lost $22.4 million for the quarter and $131 million for the full year. Reed said that the pandemic resurgence hit advertising hard during the holiday season and was also a setback for Gannett’s events business.

Gannett also is choosing to invest in growth initiatives like a sports gambling partnership and its marketing services business rather than drop more cash to the bottom line.

Reed offered several other details on how Gannett is executing a strategy of moving away from print in favor of digital. In 2021, the company sold 70 smaller publications, most of them weeklies, that had poor digital prospects and “were overdependent on print.”

Also, as previously announced, the company will discontinue Saturday print editions at 136 of its 250-plus dailies by the end of this quarter, asking readers who like a traditional presentation to use an e-replica edition instead.

With Gannett’s move, six-day rather than seven-day print frequency is fast becoming the industry norm. McClatchy halted Saturday print editions at its 30 dailies in 2020. Other papers have made even deeper print frequency cuts including the Tampa Bay Times, The Arkansas Democrat-Gazette, the two papers in Pittsburgh and the two in Salt Lake City.

Gannett’s national flagship USA Today switched to a paywall less than a year ago. It announced just this week that USA Today subscribers will have the added benefit of access to e-editions for whatever regional papers they want to see.

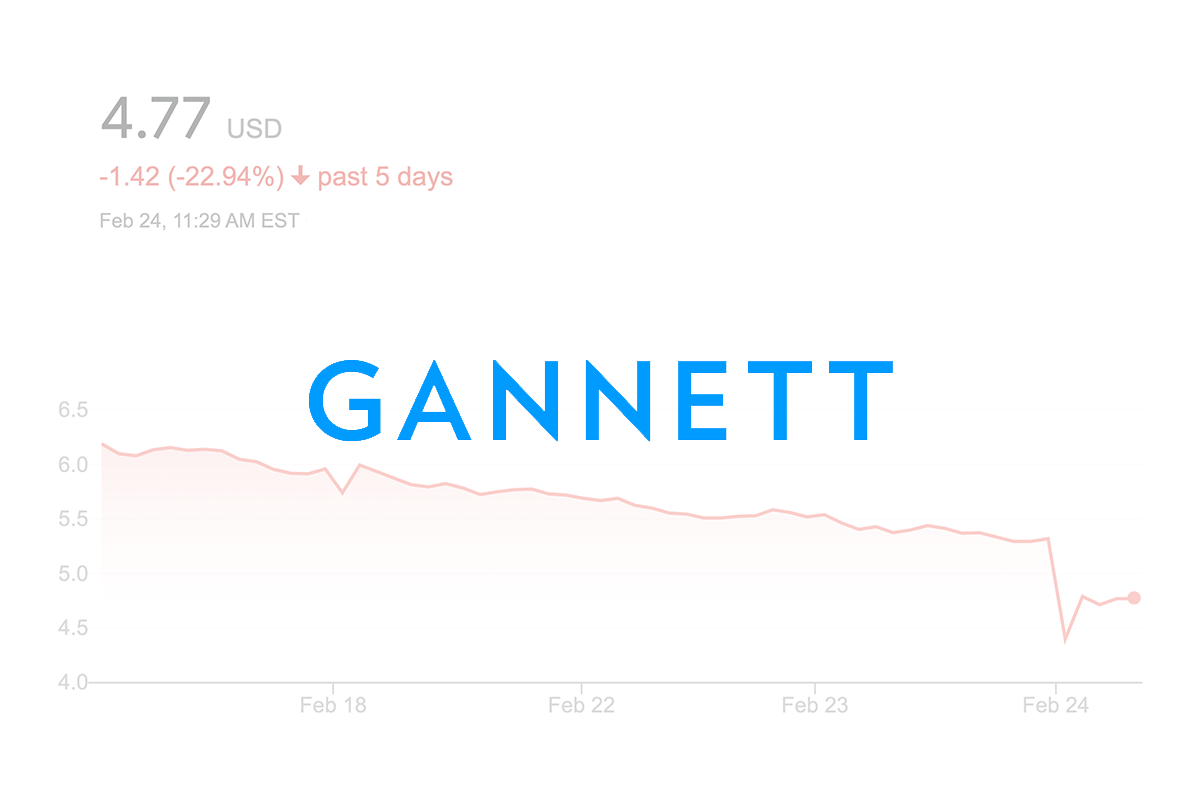

Gannett shares have been trending downward for the last 10 days and declined another 10% to $4.75 in morning trading.

No comments:

Post a Comment